-3.jpg?width=1000&height=417&name=LP_1920x800%20(17)-3.jpg)

Select location

Covid-19

Entregando Cuidado na Covid-19: A Lalamove continua apoiando pessoas com necessidades de entrega neste período. No entanto, nós levamos a segurança dos motoristas parceiros e clientes a sério e tomamos medidas necessárias para termos entregas mais seguras.

-3.jpg?width=1000&height=417&name=LP_1920x800%20(17)-3.jpg)

|

How does this policy work?

|

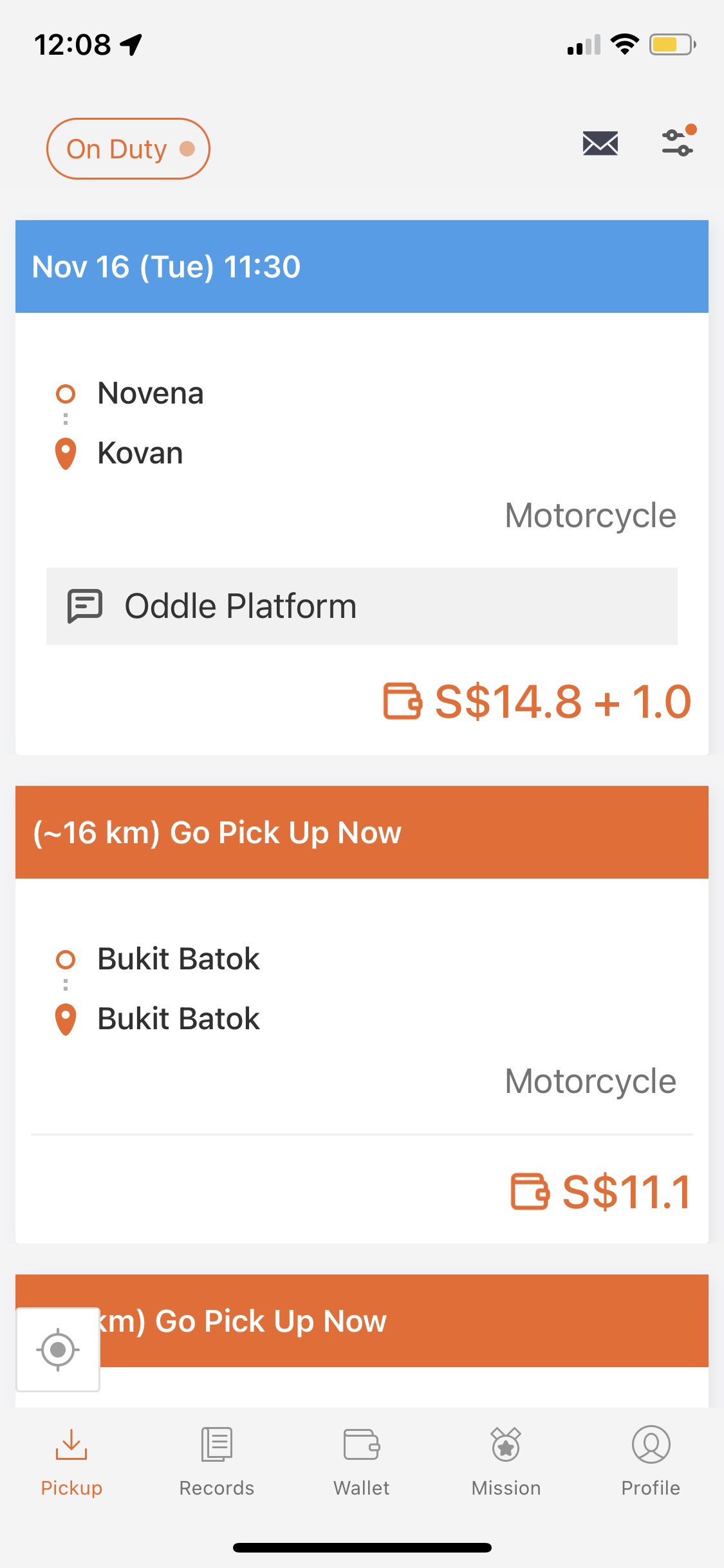

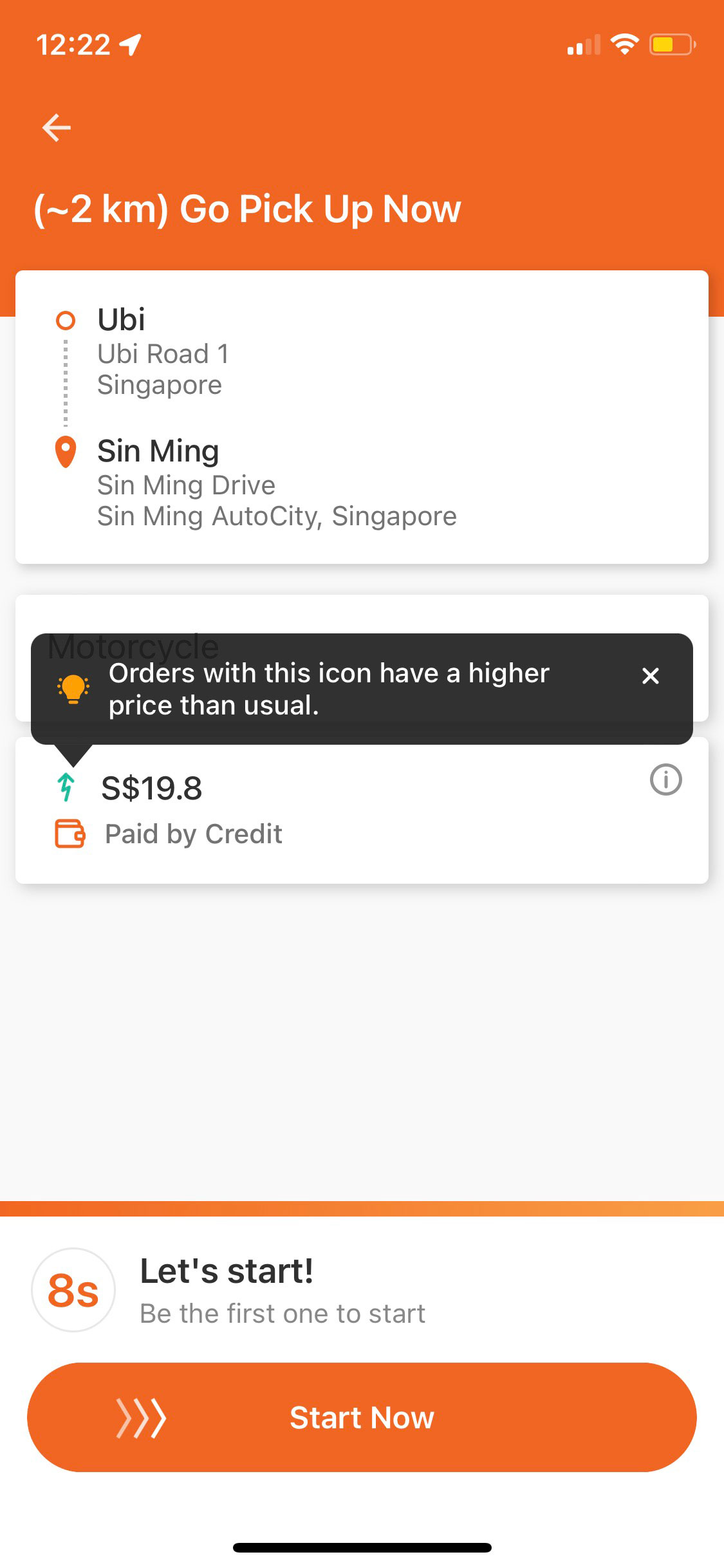

This policy is based on the Work Injury Compensation Act (WICA) for work-related accidents and will come into effect on 1 Jan 2025. Our insurance package with Chubb covers our delivery partners, including driver partners of all vehicle types and walkers. In accordance to WICA, you will be covered during Pick Up and Delivery.

|

|

1. Pick-up

|

When the platform worker begins to travel to the pick-up or collection location until the platform worker leaves the pick-up or collection location, including returning to the vehicle, where applicable for delivery platform services.

|

|

2. Delivery

|

When the platform worker begins to travel to the drop-off or delivery location until the platform worker leaves the drop-off or delivery location, including returning to the vehicle, where applicable for delivery platform services.

|

|

When will I be covered

under the policy?

|

The insurance protection will come into effect when you travel to pick up an order. The insurance protection will end either after you have dropped off the order or for those with vehicles after you have returned to the vehicle from dropping off the order.

|

|

Medical expenses covered |

Loss of income support |

Permanent disability or death insured |

.jpg?width=982&height=385&name=table%20(3).jpg)

|

In accordance to WICA,

you are not covered under WICA if you injure yourself:

|

|

|

|

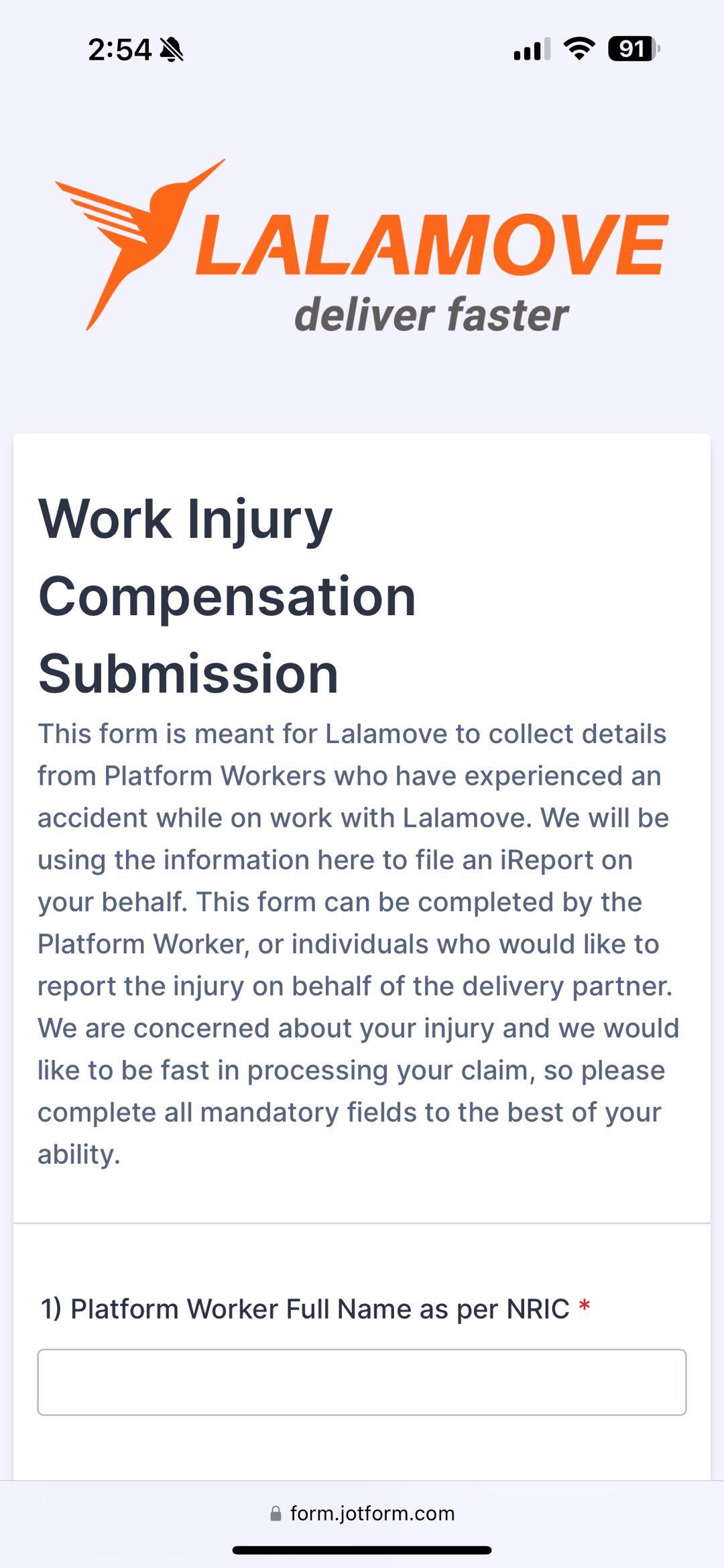

If you or your legal representative

wishes to make a claim,

please inform Lalamove as soon as possible.

|

Please prepare the following supporting

documents to make a claim:

|

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients.

The company is defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb employs approximately 40,000 people worldwide.

Additional information can be found at: www.chubb.com.

If you or your legal representative wishes to make a claim, you or they must:

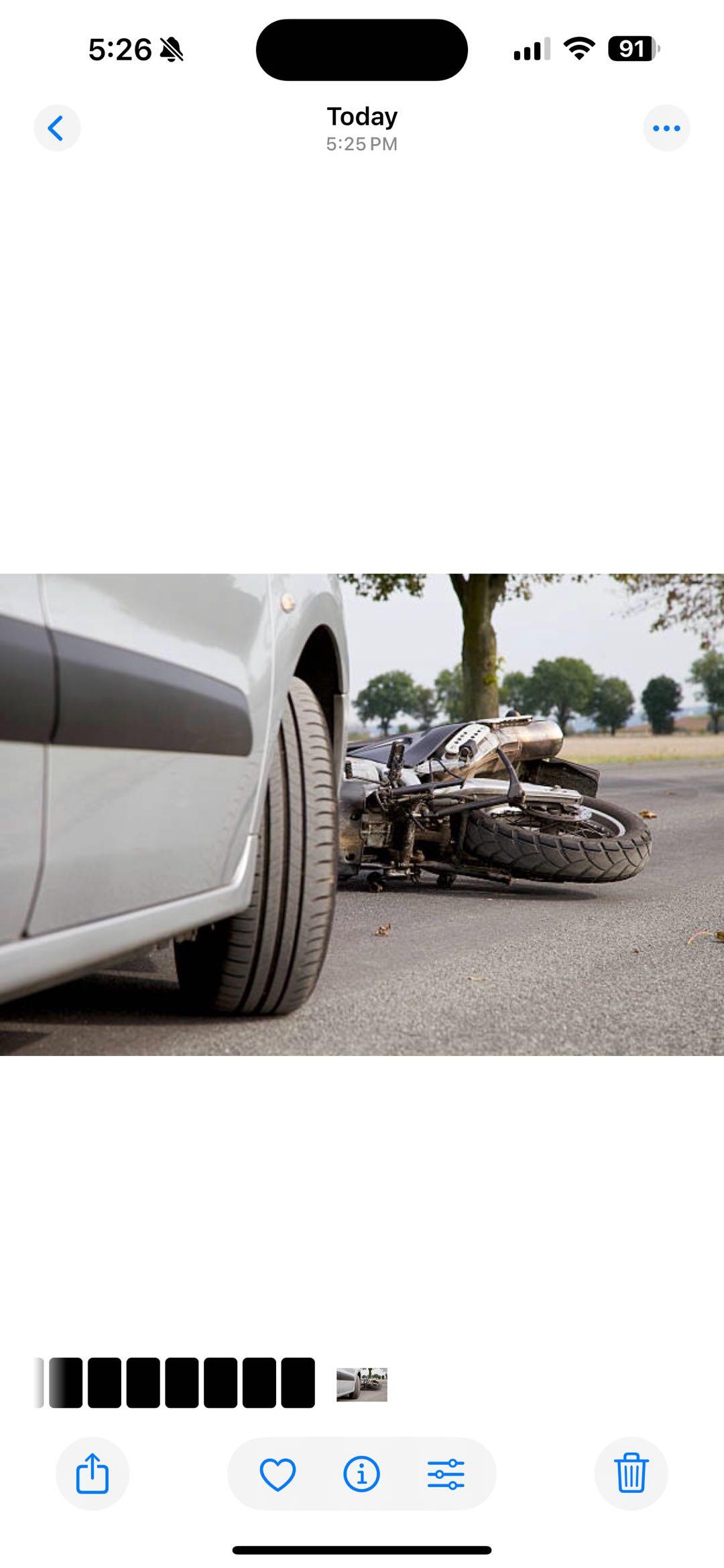

a) Screenshot of the Lalamove Delivery Platform with your booking reference and trip details;

b) National Registration ID and/or Passport photocopies

c) Copy of a Valid Driving License

d) The accident date, time and location.

e) Medical Receipts, Medical Reports and any other documents related to your injury

f) Photographs of the accident site/damaged vehicle(s), injuries sustained.

g) Contact details of witnesses, if any.

h) Supporting information from the Lalamove app to show which work task you were performing at during the time of the accident.

i) Any reports that have been obtained from the police, a carrier or other authorities about an accident, loss or damage (if applicable)

j) Police investigation outcome in the event of a road traffic accident (if applicable)

k) Any other documentary evidence required by Us under the Policy.

l) Your bank account information (for claims reimbursement if claim is approved)

m) Any other documentary evidence required by Us under the Policy.

Yes. The insurance protection will come into effect when you travel to pick up an order.

The insurance protection will end either after you have dropped off the order or for those with vehicles after you have returned to the vehicle from dropping off the order.

Some exceptions to this policy are:

You are not covered under WICA if you injure yourself:

While not working for a platform operator

While waiting for tasks, including doing non work-related activities such as running personal errands in between tasks

While performing tasks under the influence of alcohol or drugs

Deliberately, or you deliberately aggravated an accidental injury

In a fight or an assault on one or more persons other than for self-defence or with consent of the platform operator

While performing tasks using an illegally modified vehicle which caused an accident

While performing tasks using a vehicle for which you do not hold the appropriate vehicle licence such as a driving or motorcycle licence, or a power-assisted bicycle and e-scooter mandatory theory test certificate

While performing tasks using an unregistered Personal Mobility Device (PMD)

After acknowledgment of the claim, it may take up to 10 working days for the policyholder to receive a notification that your claim has been accepted or rejected provided all necessary supporting documents have been received.

You may contact Chubb directly for further enquiries.

You may reach Chubb’s Customer Service Representatives from Mondays to Fridays, 9.00 am to 5.00 pm, excluding Public Holidays, via WhatsApp or call +65 6299 0988.