What To Do After Collecting Keys To Your BTO in Singapore

Receiving the keys to your new home is an exciting milestone, but the journey to settling in can be challenging.

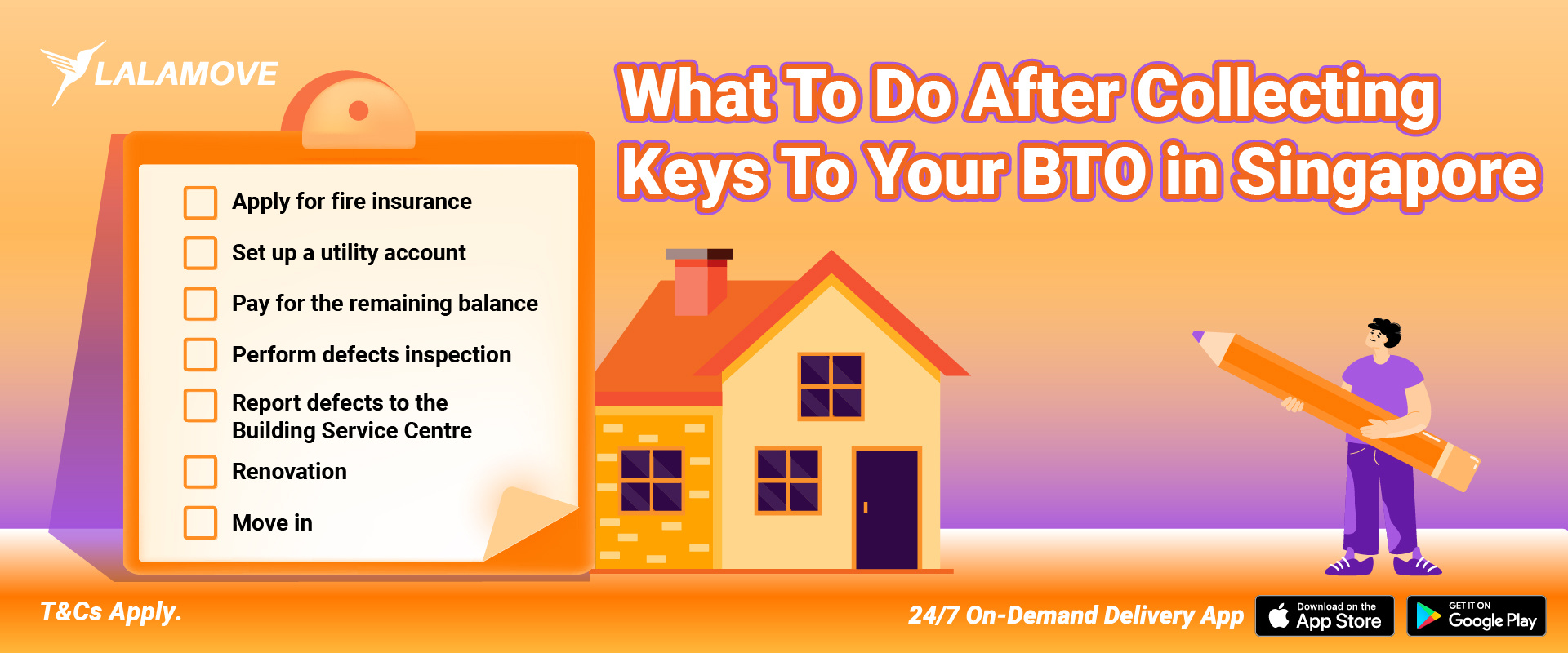

As a first-time homeowner, the initial months may feel daunting, especially after you've officially collected your keys. There's much to consider, from applying for fire insurance and setting up utilities to handling finances and preparing necessary documents for key collection.

Here’s a step-by-step guide to help you navigate this important phase as you prepare to make your BTO your dream home!

Step 1: Apply for Fire Insurance

Before heading to HDB's main office to collect your keys, you must apply for HDB fire insurance. Etiqa is the only insurance company appointed by HDB.

It is a requirement for homeowners to purchase fire insurance as it helps to relieve the financial burden of repair works in case of accidental fire incidents. The fire insurance is valid for 5 years; homeowners must renew it every 5 years.

As a homeowner, you are encouraged to acquire both fire and home insurance. The difference between fire and home insurance is that HDB fire insurance only covers building structures, fixtures and fittings damages and can only be reconstructed by HDB or its approved developers. Fire insurance is mandatory for homeowners who have existing HDB housing loans.

On the other hand, home insurance has different types of coverage depending on the insurers. It usually covers household items, personal belongings, renovations, cost of alternative accommodation, repair costs and any personal liability cover against damages to a neighbour’s property. Home insurance is not mandatory for homeowners and can be purchased with any insurance company.

Step 2: Set Up SP Utility Account

It is also important to set up a utility account with SP Group and ensure that your SP Service Account is activated at least one day before your key collection date. This way, if you plan to conduct the defects check on the same day as collecting your BTO keys, you will have access to running water and electricity for your checks.

To set up your SP utility account, you may apply for the account at one of their service centres or do it online. You need to have your identification card, proof of ownership to apply for the account and a signed and completed application form for in-person submissions. Opening a utility account requires you to place a security deposit, which will be refunded to you upon termination if there is no outstanding balance.

Step 3: Pay Remaining House Loan

Another essential step is to plan your finances. If you do not have adequate funds on hand to pay the remaining balance payment, check on your eligibility for a bank or HDB house loan. With HDB loan, you can choose the quantum to borrow, the length of your loan and the allocation of your CPD deductions.

Documents you need to prepare when collecting your keys are a working Singpass with 2FA activated, your physical identification card, your Marriage Certificate if you are under the Fiancé/Fiancée Scheme, your application for fire insurance, a completed HDB Appointment Letter and completed GIRO forms if you are paying by monthly instalments or in full.

Step 4: Conduct Defect Inspection

All BTOs are covered under the Defects Liability Period (DLP) for one year. Homeowners will need to inspect for defects before starting their home renovation to avoid confusion between the building contractor and the renovation contractor over who is responsible for any damages that may arise. Homeowners can perform the performative inspection themselves or hire an experienced specialist to inspect the house.

The purpose of the Defects Inspection is to check and fix any noticeable defects or imperfections caused during the building process done by HDB constructors. It is important to report all the defects, even the slightest imperfection as the rectification is free and highly encouraged by HDB. The Defects Liability Period covers only defects caused by HDB’s construction and usually takes less than 2 weeks to be completed. Any renovation work must be halted during the repair period.

Key Areas for Defect Inspection

- Walls & Ceilings

Check for any cracks, stains and lines. Hairline cracks may result in bad and uneven painting while bigger cracks may indicate underlying issues in its structure integrity. Stains may indicate water seepage or leaks, which can be a costly fix if left unattended.

- Floors

Check for any cracks, unevenness, hollowness, stains, colour disparities and gaps. All these defects may suggest improper subfloor preparation and poor workmanship.

- Doors & Windows

For the doors, check for the hinges to ensure it is not rusted, loose, or squeaky. Testing the locking mechanism for the front main door and any interior doors in the house including duplicated keys.

For the windows, ensure the rubber sealing around the windows is properly intact and sealed. Open and close each window to ensure that it opens smoothly and quietly, test the locking mechanism as well as assess the noise level when it is closed.

- Bathroom

Plumbing checks are also crucial as newly installed plumbing may still need to be fully tested for daily usage. It is key to ensure no small leaks, issues in water pressure, or incorrectly installed pipes.

Step 5: Report Defects to the Building Service Centre (BSC)

Once the defects inspection has been completed, homeowners can either book an appointment online or head down to the nearest building service centre.

Homeowners can either request for the building service centre constructor to review the defects identified or submit via the feedback form.

Step 6: Renovation

Designing your dream home is one of the most exhilarating parts of owning a home, but renovation can only begin when HDB has rectified the defects completely.

Before choosing a contractor or interior designer, prepare a detailed mood board, budget and timeline.

- Obtain your house plan flooring to visualise the layout and choose a theme that suits you best. Planning out a design mood board allows you to have a visual clarity of the overall space and an easier way to communicate your ideas with the relevant parties.

- Choose a contractor or interior designer who is officially accredited by CASE and has a history of authentic positive reviews. Research and plan out a budget to avoid unexpected expenses. Never pay in full upfront but in stages.

- Outline a timeline with the contractors to ensure there is sufficient time to complete the renovation and manage the moving process efficiently.

Step 7: Moving In with Lalamove House Moving Service

Moving can be expensive and complicated, but Lalamove makes it easy for you. You only pay for what you need such as extra helpers, door-to-door service or moving supplies! Lalamove offers moving solutions tailored to your needs, providing a competitive house moving service price with a complete package of flexibility and convenience.

Our Lalamove app also provides instant price quotes and a real-time tracking feature for peace of mind. A wide range of moving vehicles from 1.7M Van to 24ft Lorry for different frequencies of moving needs, with van deliveries starting as low as $26!

Say goodbye to stressful moving days and say hello to a seamless transition into your new BTO! Choose Lalamove House Moving Service for a hassle-free and easy move today, anywhere in Singapore! (yes, we deliver to Tengah too)

Ready to kickstart a new chapter in your life? Download our Lalamove app and let us handle your move today!